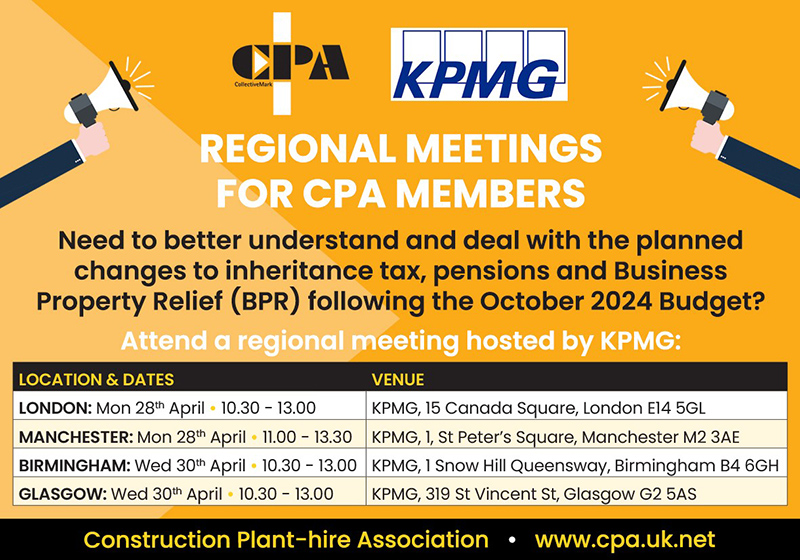

THE Construction Plant-hire Association (CPA) is co-ordinating a series of regional meetings across the UK – including one in Glasgow – at the end of April to help members better understand the planned changes to inheritance tax, pensions, and Business Property Relief (BPR) following last year’s UK budget.

CPA members are invited to attend the meetings which are being hosted by KPMG. The Glasgow event will be held at KPMG’s premises in St Vincent Street on April 30 from 10.30 to 1pm. Other meetings are scheduled for London (April 28), Manchester (April 28), and Birmingham (April 30).

Steve Mulholland, CPA CEO said, “The budget in October 2024 announced changes to how inheritance tax applies to privately owned businesses. Under the previous regime trading businesses could potentially be passed to the next generation without incurring an inheritance tax charge. Going forwards for many trading businesses it is likely that an Inheritance tax charge of up to 20% of the value of the business could apply on shares passed to the next generation.

“This is a material change for family businesses, with the rules expected to come into effect from 6th April 2026. We would like to invite CPA members to attend a meeting in their region, whereby KPMG will provide expert advice as to what these changes mean for family businesses and what options families have both in advance of the rule change in April 2026 and beyond. Let me be clear that we shall continue the fight for this to be reversed.”

During the meetings, KPMG will outline the changes, explaining the current and future positions. There will be a discussion about the types of succession planning strategies that other family businesses use, explaining the commercial and tax implications of these; and an open discussion and Q&A session where members can discuss with each other the impact of the changes and ask any questions.

For further details or to confirm attendance, please email enquiries@cpa.uk.net and indicate which meeting/location you would like to attend.